What’s underneath the surface? - Looking back at the market (non) activity this summer

Hot action above the surface, cold waters underneath! Paul Palmer illustrates it in his kayak. If you need commercial real estate in the Colorado Springs area, reach out to Paul and Michael Palmer for advice https://olivereg.com/broker/paul-palmer/#/search/grid/?agentId=%225f6ca02c5f7425000122cf60%22

Key Takeaways:

Home prices continue to appreciate on paper (recorded sales price are up), but we see more listings are sitting on the market.

The listings sitting on the market will only impact the data (days on the market, sale price etc…) once they close. We might see signs of a slowing market in the next few months, once these listings flush through the system.

We see too many high price tag listings, and not enough affordable homes for sale. This trend is pushing prices up down-valley, where buyers can find more budget friendly options.

In this context, as long as inventory stays low, prices will maintain or climb. But at today’s price, the demand won’t absorb any excess inventory.

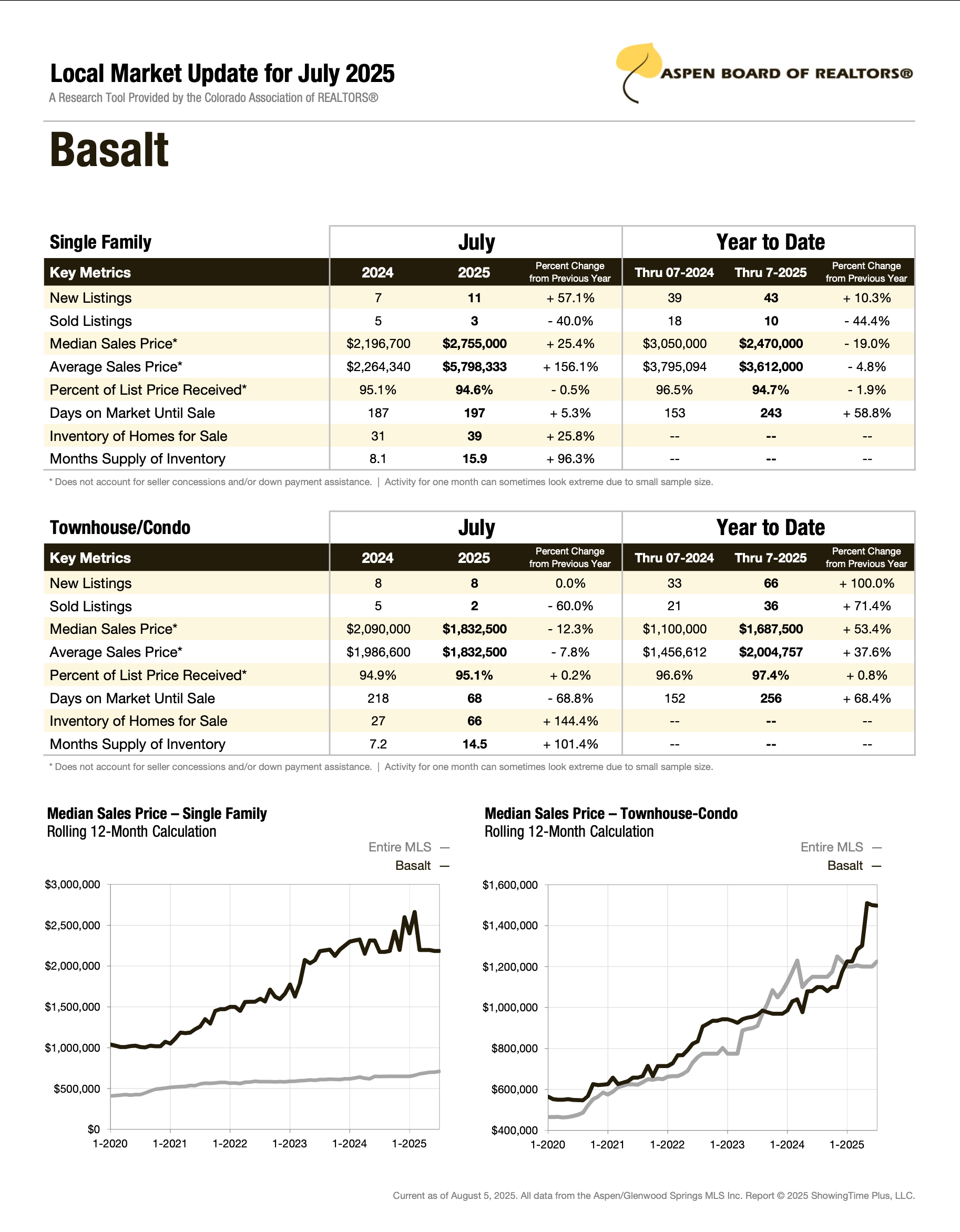

Scroll down to the bottom of the article for a breakdown of the latest market data per town.

Hot action above the surface, cold waters underneath!

As you can see in the market stats at the end of this article, the most recent numbers from NAR for our valley would suggest optimism. The rush to affordability is making a real difference down-valley, with Rifle showing over 8% year over year appreciation of the median sales price, Silt 24% and New Castle 7.7%. Glenwood Springs also shows some strong numbers, with a median sales price now settling over the $1.1m bar ($1.17m year to date).

Inventory remains low, but has been expending especially in Glenwood Springs and Aspen (25%+ in both towns). Homes have not stayed on the market for longer, and days on the market have been actually going down overt the summer.

But if we look under the hood, things might not look as rosy. It’s important to mention at this point that data gets recorded at the time of closing. So it shows what happened on the market… But what about what’s not happening? The struggle to find buyers for the excess inventory of expensive homes in Glenwood for example, telling a different story than the headline does. We don’t see in the market data published by NAR:

How many homes actively listed that have not sold yet? (Days on the market are published once a transaction closes)

How many would-be buyers giving up on buying a home? What is the level of demand, for each town and for each price point?

How many sellers taking homes off the market after being unsuccessful in their attempt to sell?

We can at least answer the first question but running an MLS search. At the time of writing this article, 1,370 properties were actively listed on the MLS. Amongst them, over 650 (about half) have been listed for over 100 days! If you remember 2 or 3 years ago, anything that didn’t get bought in the first week was a weak link.

A mismatch between supply and demand

In the Glenwood Spring area:

Only 20 listings out of 75 are under $1 million at the time of writing this article

37 of those are above $1.5 million

In other words, there is an oversupply of expensive homes, especially if they are in need of updates. In the meantime, the lower end of the price range is deserted, and home buyers have shifted focus towards the down valley. The fact that the extra supply in this segment of the market is not being absorbed goes to show that his market can fail.

The tree that’s hiding the forest

We’ve been operating for over 3 years under a very low level of inventory. All the numbers that were recorded in the market data show ever climbing prices, but these numbers are based on recorded sale. And there isn’t very many of them. All this is telling us is that the people who actually transacted did it for a high price.

In the same time, we’ve all felt the dichotomy of seeing prices increasing on one hand, and hearing most people’s complains of being discouraged and disqualified by the current market conditions on the other. The transactions recorded are the tree hiding the forest of transactions that simply can’t happen. And because the current market dynamics seem a little out of breathe, and some segments of the market have become oversupplied, we are starting to see the forest behind the tree. The gap to bridge between the prices expected by sellers based on recent comps and the prices that the bulk of the demand would need to actually transact has grown bigger and bigger over the last few years of low inventory. How low do prices need to go to meet a larger size demand?

If the inventory remains low, this dynamic will keep going for a while. As we are seeing on the top end of the price range, with homes sitting on the market for longer, any increase in inventory is going to slow down the pace of transactions dramatically. So the question remains… Are we going to see more inventory come in?

It could be that it’s a game of trees from now on, and that you should forget about the forest

The “golden handcuff'“ effect is here to stay, with current homeowners having locked in 30 years worth of mortgage at extremely low rates just a few years ago. I’ve described the Prop 13 effect on California real estate in a past article (click here) to illustrate how government intervention (such as the FED lowering interest rates to zero during COVID, creating the 3% rate refinance wave then) can set the course for a real estate market on the long run. The 3% rate of 2021/2022 are the Prop 13 of the entire country, for a 30 years period.

That being said, the decision to sell a home isn’t always a financial calculation. It also happens because of life circumstances. Marriage, pregnancy, divorce, death… There are a lot of reasons to buy or sell a home. But these things typically don’t come a sudden, massive waves. They trickle over time. And I don’t see how the would provoke a sudden market turn that would change the current market conditions of high prices and low inventory.

If nothing dramatic changes in the financial landscape, we will continue to see the low levels of inventory sustain high prices for a while. But if anything derails the economy and people need to sell in higher number, it’ll be interesting to see how much lower price need to go until buyers come in numbers to scoop them up.